by Sentimenti Team | Jan 15, 2021 | SentiBrand, Sentistocks

Cyberpunk 2077 has already premiered, and the emotions surrounding this event are extreme. The inspiration for this comparative analysis came from the comments surrounding a post made by Michał Sadowski, the creator of BRAND24, on his private Facebook profile. The entry refers to the reception of the game by Internet users. Our attention was drawn in particular to comments regarding the use by investors of sentiment as an analytical tool.

Cyberpunk 2077 and CD Projekt share price. Sentiment analysis a tool for investors?

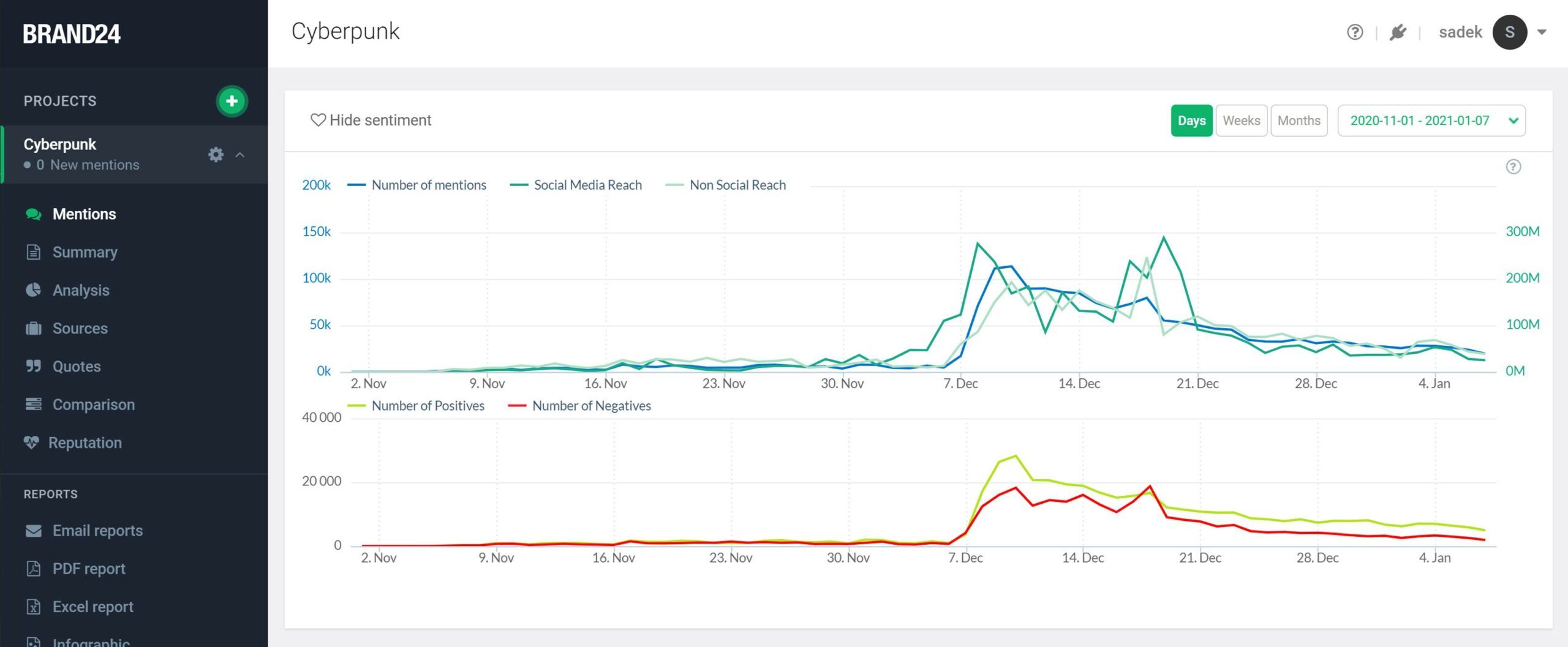

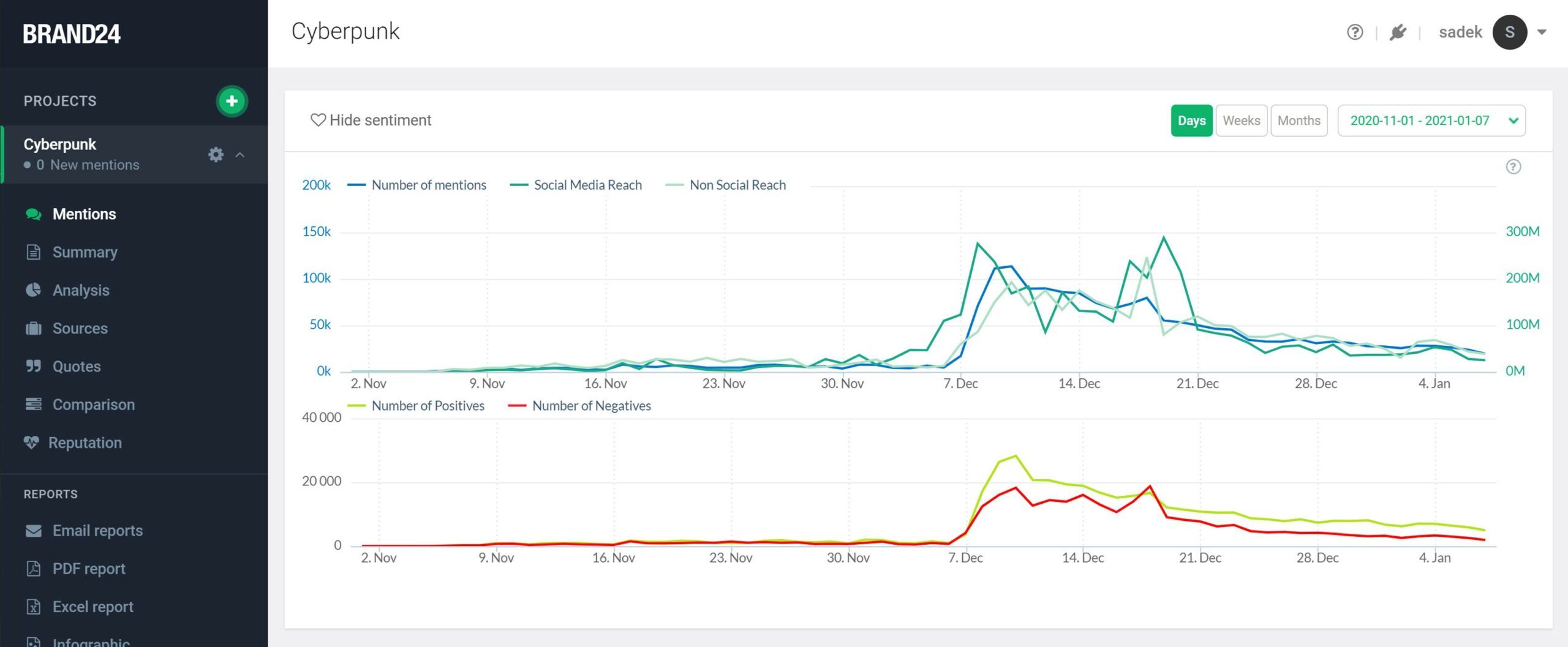

Generally available media monitoring tools offer automatic sentiment analysis (quantitative) as standard. However, we should ask ourselves whether we can infer changes in emotions on the basis of such analysis? If the opinion was negative, how negative? Is it possible to draw conclusions about measurable parameters on the basis of such an analysis? Such a parameter is undoubtedly the price (course) of shares. But based on such a chart, was it possible to predict what would happen to the share price of CD Projekt?

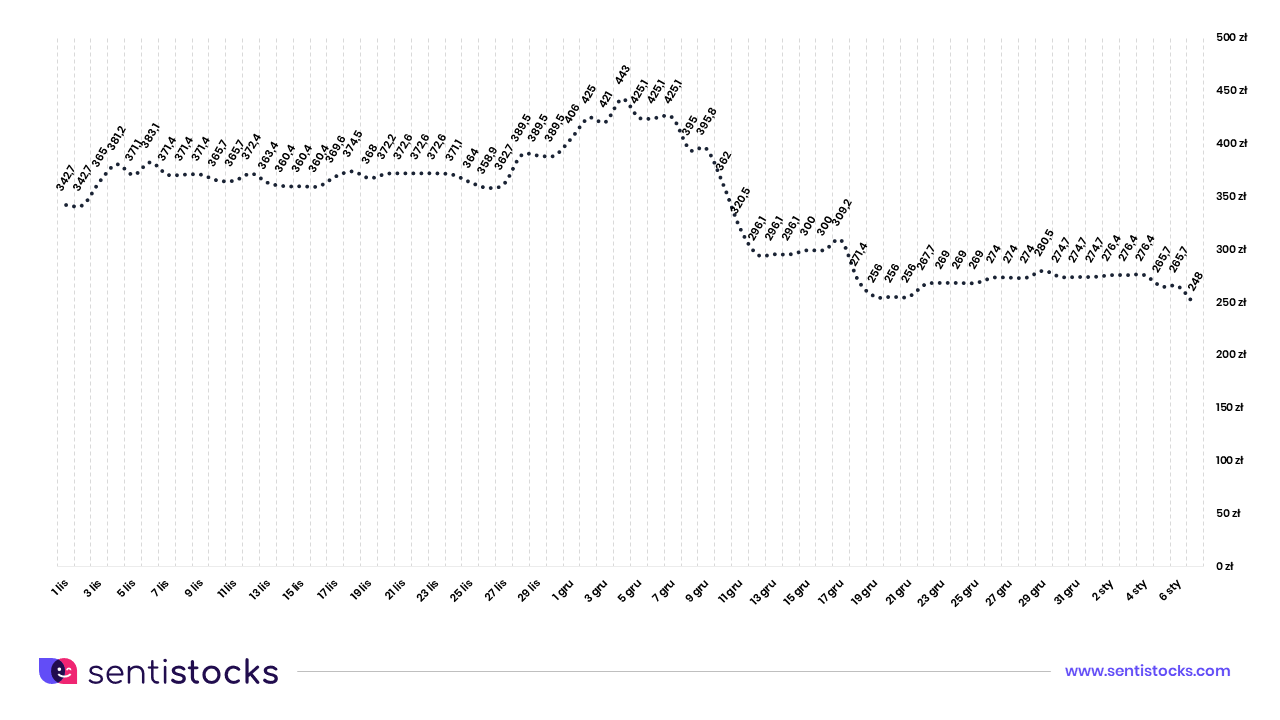

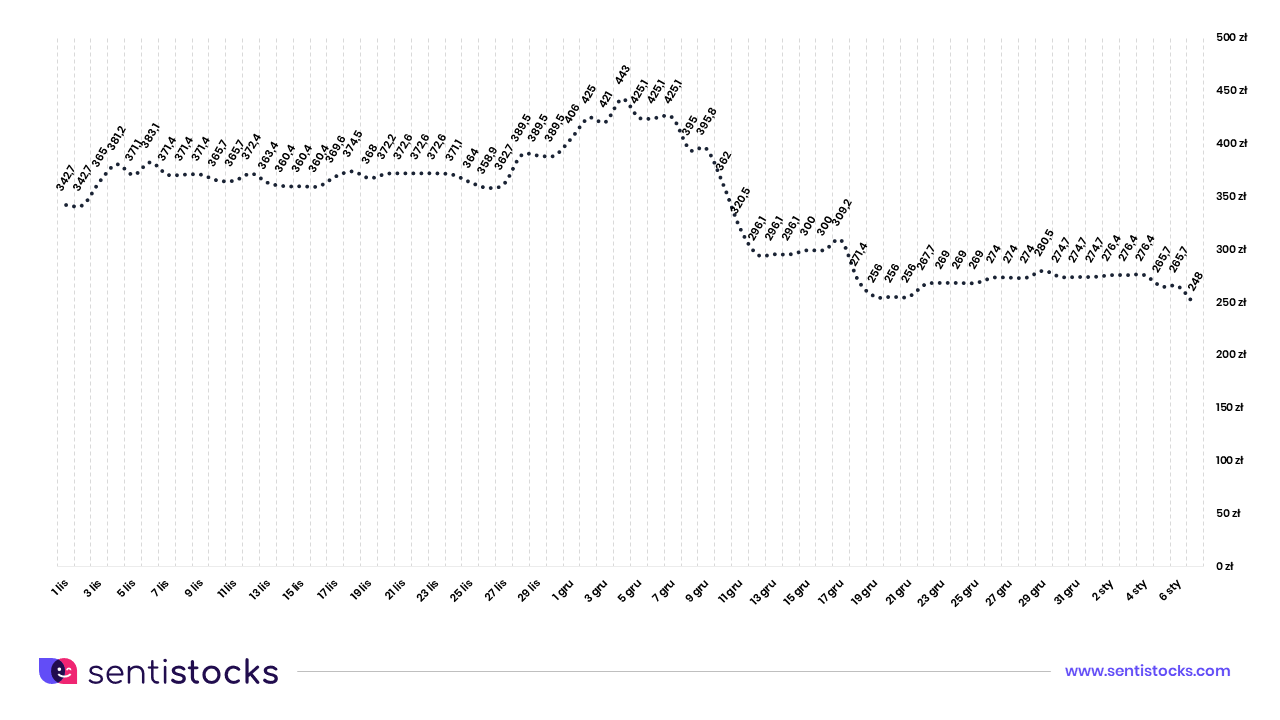

Sentiment analysis indicates that there was a significant predominance of positive sentiment over negative sentiment (quantitatively) during the period 7-14 December 2020. Would this indicate that such sentiment was confirmed by the upward trend in the price of CD Projekt shares listed on the WSE? Below we present the share price chart for this company (creator of Cyberpunk 2077) during the corresponding period.

The share price chart shows the opposite situation from the sentiment chart. During the period in question (7-14 December 2020), CD Projekt’s share price recorded a significant decline, but the predominance of positive over negative sentiment visible in the tool did not indicate this at all.

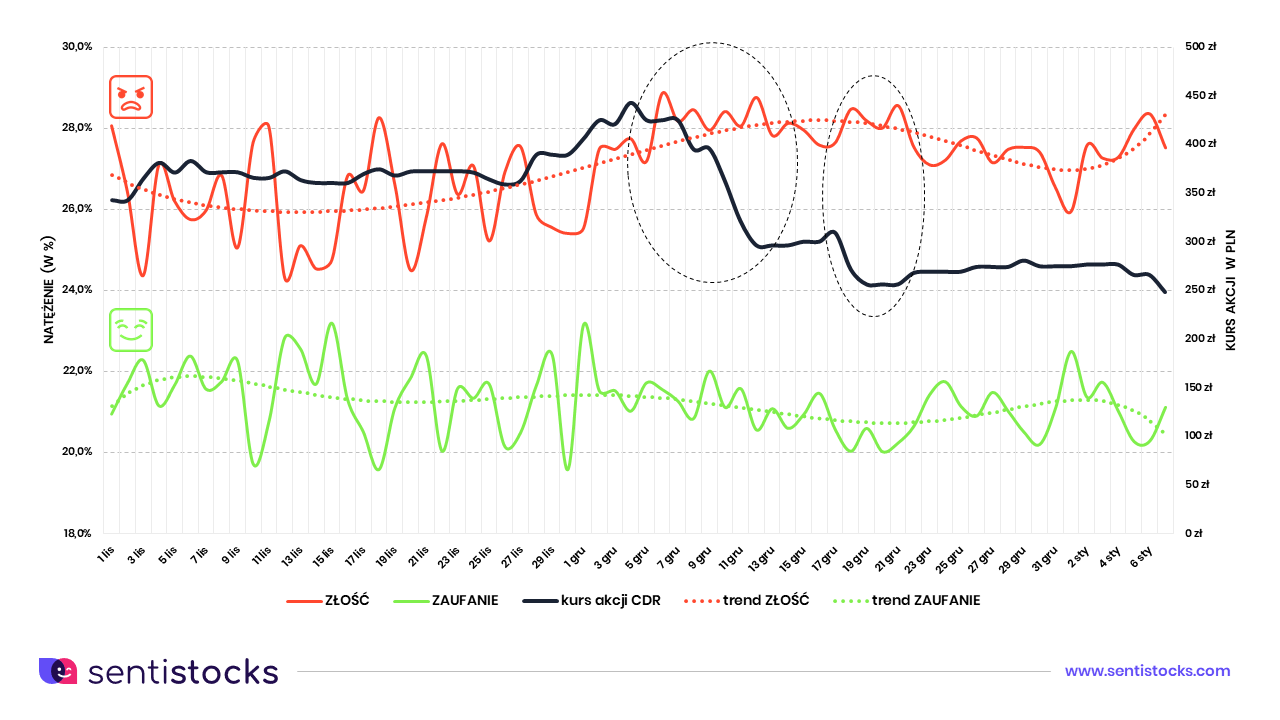

Emotion analysis. Could you have predicted the stock market trend?

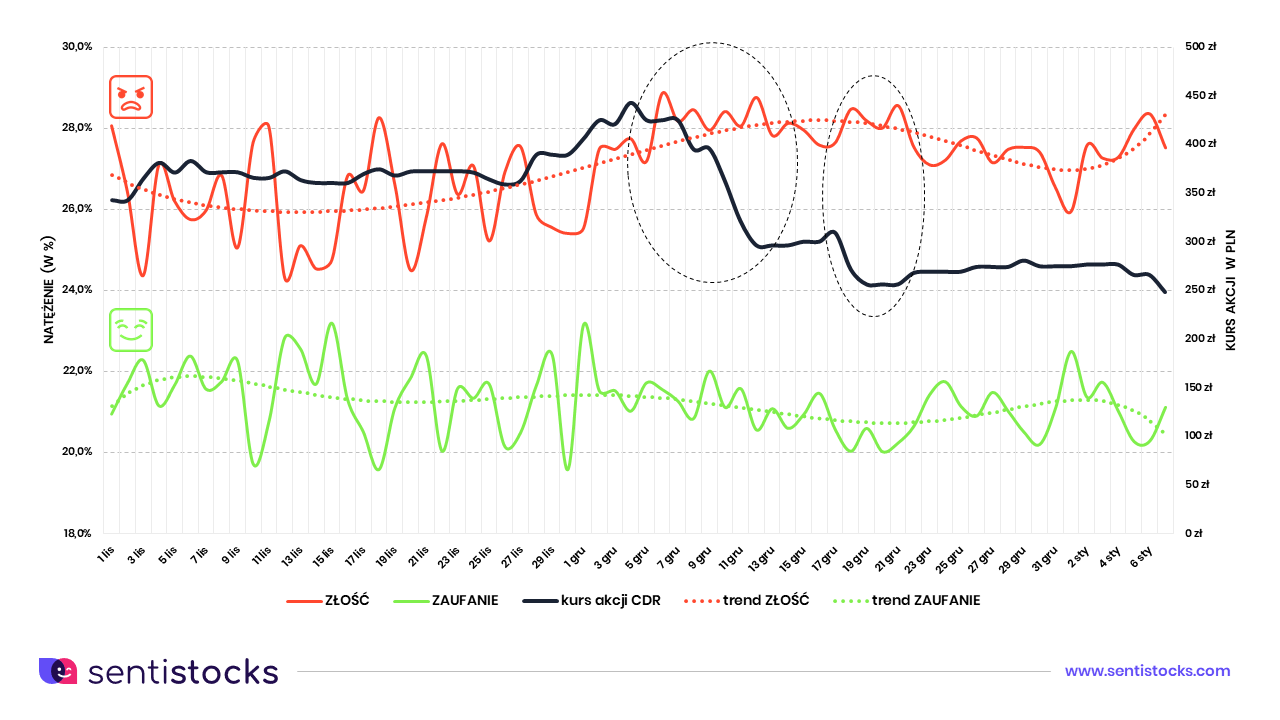

The answer is yes! Analyzing the intensity of the eight basic emotions (not sentiment) it was clear that two in particular stood out during this period. These were anger and trust. By observing the correlation between them we could see a specific trend behavior. We have additionally marked two key moments on the chart.

A 30% drop in the price of CD Projekt shares was recorded between December 7 and 12, 2020. Moreover, the period from December 17 to 19 last year saw another, this time 17%, price decline. It was during these time periods that the maximum divergence (i.e. the maximum difference in intensity) of the emotions ANGER and CONFIDENCE occurred.

The intensity of anger reached its maximum values with a simultaneous downward trend in the intensity of trust. What conclusion can be drawn from this? First of all the conclusion is that it was not the level of sentiment that signaled foreseeable drops of the company’s share prices. It was the emotions themselves, and more specifically the observation of changes in their intensity during a key moment for the company.

The analyzed case of the Cyberpunk 2077 game was a very simple case study for emotion analysis. It was accompanied by a huge information noise caused by the game’s release. The emotion analysis used in the SentiStocks tool therefore allows for very precise price predictions of various financial instruments. Therefore, its use can be a real support for investors in their decisions, and it can often help predict potential image crises.

At this occasion it is worth mentioning about even 85% effectiveness of emotion measurement in predicting the price of e.g. Bitcoin. Our tools perfectly cope with this. You can read more about this topic HERE.

by Sentimenti Team | Aug 28, 2020 | Sentistocks

Sentistocks emerges on the market with a very innovative approach to crypto analysis. The Sentimenti project focuses on the use of 8 emotions measurement and arousal to accurately predict the price trend of market assets.

From now on it has collaborated with leading cryptocurrency data aggregator – Coinpaprika to provide a new feature – widget presenting daily forecast for Bitcoin (BTC) price.

The tool will be constantly improved and expanded with more features to analyze the most important cryptocurrencies for key stock exchanges, in shorter intervals (1hr – 8hrs).

Soon, there will be expanding solutions, analyzing the most important cryptocurrencies for key exchanges, in shorter intervals, between 1h and 8h.

Sentistocks, apart from the crypto market, applies its innovative analyses on other markets and instruments, such as stock indices or F/X market.

by Grzegorz Stefański | Dec 21, 2018 | Sentistocks

This time the article was prepared by Grzegorz Stefański, our financial advisor. He proposed to check whether the emotions expressed in the entries about KNF (Financial Supervision Authority) will allow to predict changes in bank indices.

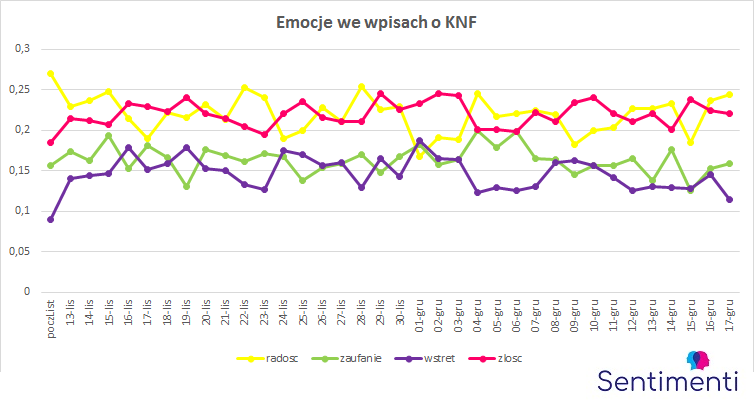

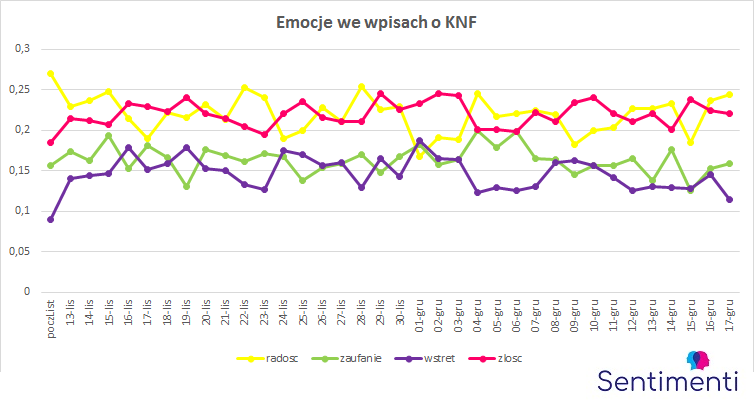

In Brand24 tool we collected data from the period from 1 November to 17 December. As there was not much writing about the Supervision Authority before 13 November, we treated these 12 days as one starting point for data to which we compare further changes in sentiment and emotions expressed by Poles. As can be seen in the chart, before 13, about 200-400 mentions were written daily. On the day the scandal broke out, the number rose to over 20 800 and until today it did not fall below 700 (the least talk was about the KNF on December 5).

The banking sector on the Warsaw Stock Exchange has always been regarded as one of the more stable and relatively insensitive to sudden fluctuations. However, this stable sector is not immune to sudden turmoil, either. For nearly two months now we have been able to follow the events related to the so-called “KNF scandal”. It is clear that the situation in the KNF was very important for the banks’ listing on the WSE in the form of at least two stimulators.

The first one is media information about a conversation between the then President of the KNF and the owner of Getin Bank. The second is the detention of former members of the KNF management. It was November 13th and December 6th respectively. These events had the same resonance for the banking sector. When analysing the changes in the WIG – Banks exchange rate in that period, we notice the following reaction of the stock market with some time delay. This applies to the WIG – Banks quotation on 16 November. On that day, one of the three lowest closing prices in a year (7161.54) was recorded, while on that day the lowest price in a year (7040.86). There can be no doubt that the reason for such a significant decrease was the media information about a conversation between the then President of KNF and the owner of Getin Bank. However, the banking sector itself defended itself with results in the following days, which resulted in an increase in the exchange rate, which was not weakened by reports of the arrest of the President of KNF by law enforcement authorities (this took place on 27 November). In this period, a mini upward trend in the exchange rate is noticeable. However, further information on the arrest of former members of the PFSA management on 06 December resulted in a significant drop in quotations – to the level of 7244.17 (on 11 December).

Source: bankier.pl

Source: bankier.pl

The question should be asked how the bank shares market will develop further? How much more turbulence is it able to withstand without causing negative reactions from stock market investors? Analysts often use the term investor moods – but what really makes up these so-called moods? Certainly, they are positively influenced by economic results, and also undoubtedly by investment safety. But investors are people who, regardless of measurable indicators, are also guided by emotions. The stock exchange is not free of emotions – we have seen it more than once. Also, the recent events related to the PFSA had a direct impact on the banking sector listed on the WSE. These events described by the media evoked certain sentiment and emotions among the recipients, and this could undoubtedly influence their behavior, causing for example the desire to get rid of their values.

At this point it is worth analysing – as a coincidence – the changes in the intensity of sentiment in the texts on KNF compared to the changes in the WIG – Banks exchange rate between 9 November and 17 December 2018.

Source: bankier.pl / sentimenti

Source: bankier.pl / sentimenti

Analysing the above chart one can notice a certain correlation between the changes in the intensity of sentiment in the texts about KNF and the behaviour of investors manifested in the WIG – Banks exchange rate fluctuations. Thus, in a situation when the positive (increase) and negative (decrease) sentiment curves were aiming to cross, it was a certain signal to increase the bank share price. It took place on 16 November and from that day onwards the price rose until 29 November. On that day the sentimentary curves spread out and a short-term price drop was recorded. After that day, the curves entered the convergence phase again and the price went up (until 05 December). On the next day (after information about the arrest of former heads of the Polish Financial Supervision Authority), the exchange rate fell. The sentimentary curves entered a phase of retreat and the exchange rate adopted a downward trend until 11 December. After that day, the sentimentary curves came close, and the exchange rate entered the upward phase again. However, since December 13th, the positive sentiment trend has seen a decrease (and at the same time an increase in negative sentiment), and this may suggest that in the following days there may be another downward correction of bank share prices.

In this analysis, only one element has been adopted which may affect the share price levels of banks listed on the WSE. This element is media information about the situation in the PFSA. However, it already gives some premises to start observing carefully and trying to study the emotions connected with the capital market. A more complete picture can be obtained by conducting broader research, especially of the basic emotions that function in the environment of investment processes taking place on the stock exchange.

It is still necessary to consider how individual emotions have changed responding to subsequent reports of irregularities in the PFSA and whether they also have predictive power. The graph with the results of the averaged daily emotions indicates, first an increase in the proportion of disgust and anger and a decrease in joy. Strong fluctuations of trust can also be observed. SentiTool as a tool to help predict stock market trends? It seems that this is quite a possible scenario.

Source: bankier.pl

Source: bankier.pl Source: bankier.pl / sentimenti

Source: bankier.pl / sentimenti