by Sentimenti Team | Apr 7, 2020 | Sentistocks

Are emotions more effective on the stock market than the sentiment is? How effective are they? We have long been studying the importance of emotions in economic analysis. How they affect the prices of various financial instruments and values quoted there. We are not the only ones – for some time now, with increasing access to published opinions, whether on portals or in social media, there are publications and researches where authors try to find correlations between investors’ mood and stock, currency, crypto rates, etc.

December 2018 revealed the publication of “Media Sentiment and International Asset Prices”, issued by the National Bureau of Economic Research. In the aforementioned read, its authors have analyzed in Reuters’ and Bloomberg articles on their impact on major stock indices. Researchers discovered interesting relationships between sentiment and index values, amongst the others:

- The mood of the news correlates four times stronger with the bear market (dominated by declines) than during the bull market (boom),

- Emotions are a much better indicator of world indices’ behaviour than the commonly used VIX (CBOE Volatility Index),

- The positive mood in the media has a more positive impact on the developed markets, but a negative one on the emerging markets.

A similar topic was researched by Yigitcan Karabulut, Goethe University Frankfurt’s Assistant Professor. He analyzed predictions on a Facebook database.

None of the approaches, unfortunately, allowed the results’ accuracy of forecasts to be higher than 55-60%. This will not be possible whilst basing on sentiment or emotional tags offered by social networking platforms like Twitter or Facebook only. In Sentimenti, we have many more possibilities – up to 11 emotional variables. Do you want more information? Look below.

Sentimenti and the Warsaw Stock Exchange

In Sentimenti we took on another milestone in financial behavioral analysis. We use deep neural networks to analyze any published text based on 8 emotions and the overall arousal. Thanks to the idea we can read investor’s moods and predict their future actions more precisely. We have already proved it by checking our tools’ effectiveness on publications related to the Warsaw Stock Exchange. As many as 87.1% of the cases with shown changes in the emotion intensity area in texts about a certain company allowed us to predict the price changes.

Sentimenti and cryptocurrencies

For everyone who has even a little interest in the market, the cryptocurrencies are known for their strong emotional connection. Values such as Bitcoin, Ethereum (or others!) don’t have a real use so far but are mainly treated as purely speculative assets. And where speculation is concerned, there also are emotions.

That is why we have set ourselves the goal of checking how strong the correlation between cryptocurrencies and emotions is. And, by the way, does the same scheme work with the positive and negative sentiment only?

To that end:

- We have downloaded all available mentions of Bitcoin (BTC) for 2018 – over a million articles, comments, or posts.

- We have examined them emotionally for 11 indicators – 8 emotions, negative and positive sentiment, including arousal,

- for the tested period we have downloaded the price quotations, including opening, closing, minimum and maximum price, taking them hour after hour (over 35 thousand indicators).

We have then implemented our artificial intelligence to help. Our IT-team inserted all the data collected for analysis and set it the task for finding correlations between these several dozen variables, both on the side of stock market prices and emotions.

We have tested the 2018 datasets on a total of several hundred different training models. Then we started forecasting the best of them for 2019. We changed the approach several times, looking at the effectiveness each time. A few examples of this analysis ale pictured below:

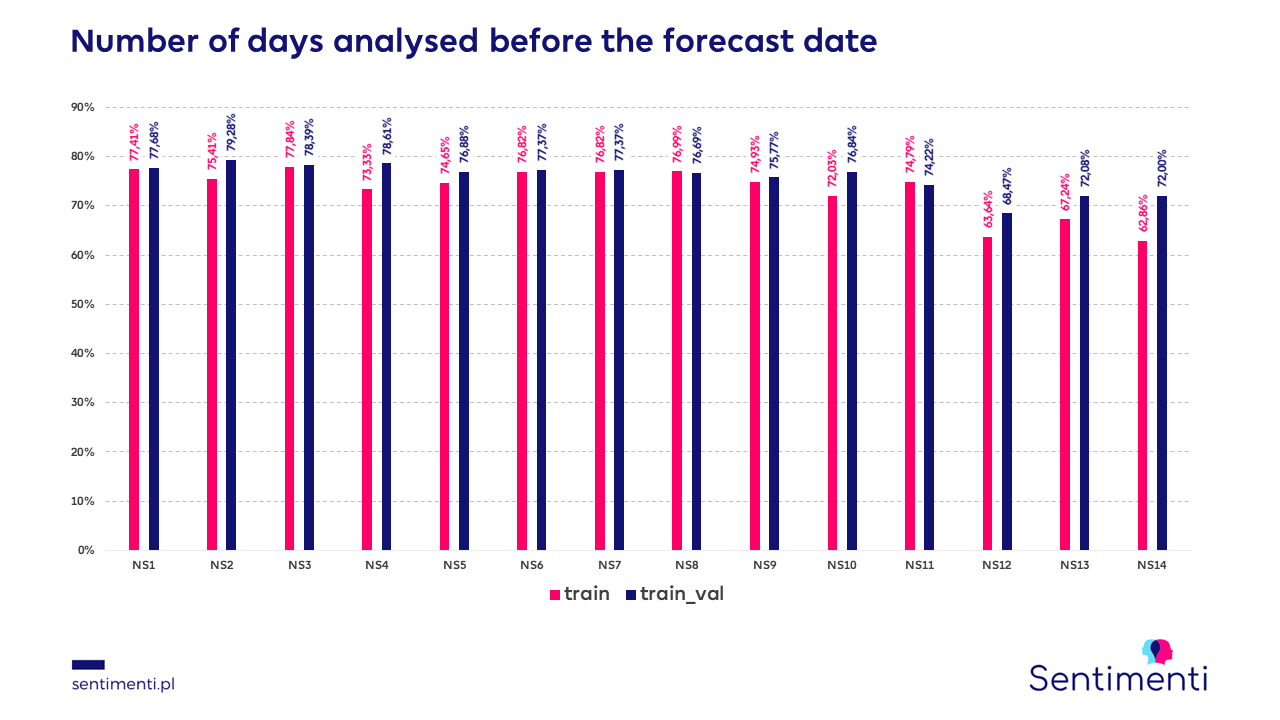

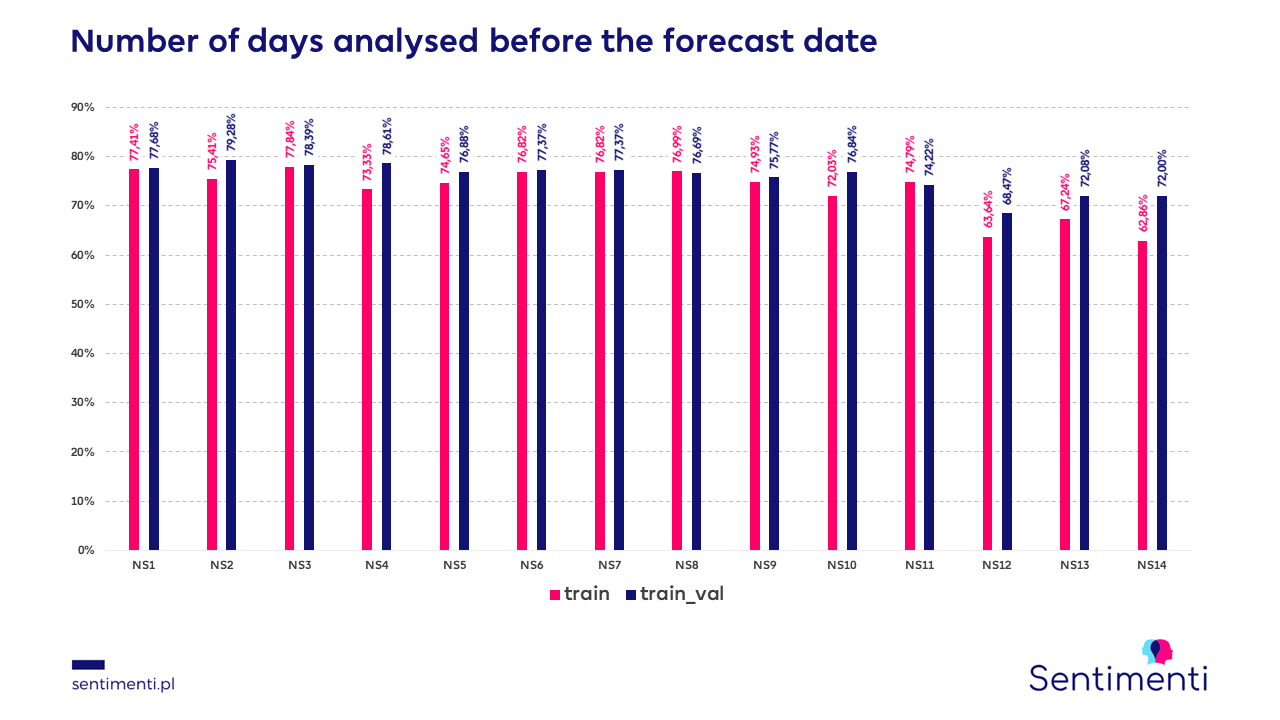

The number of days analysed before the forecast day:

We checked which number of days back best affects the quality of the predictions. We examined periods from one to fourteen days. It turns out that the best results are obtained when we analyse the last three days (77.84% effectiveness of the prediction).

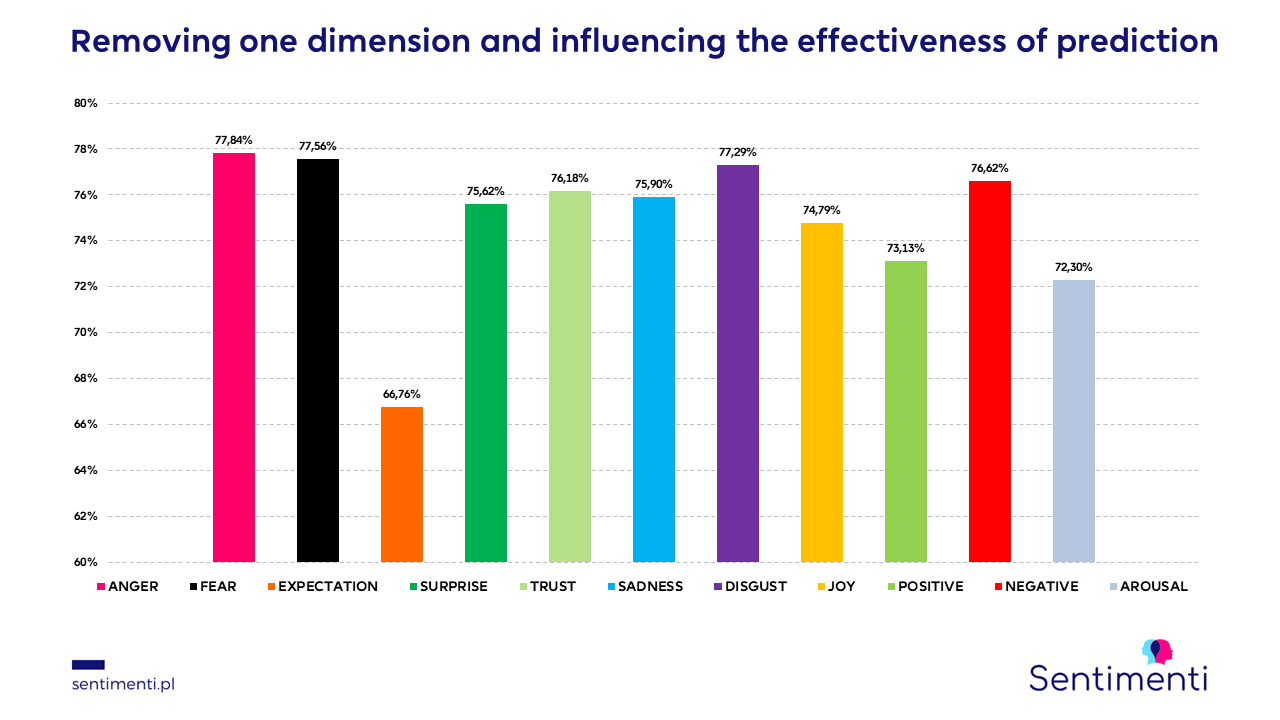

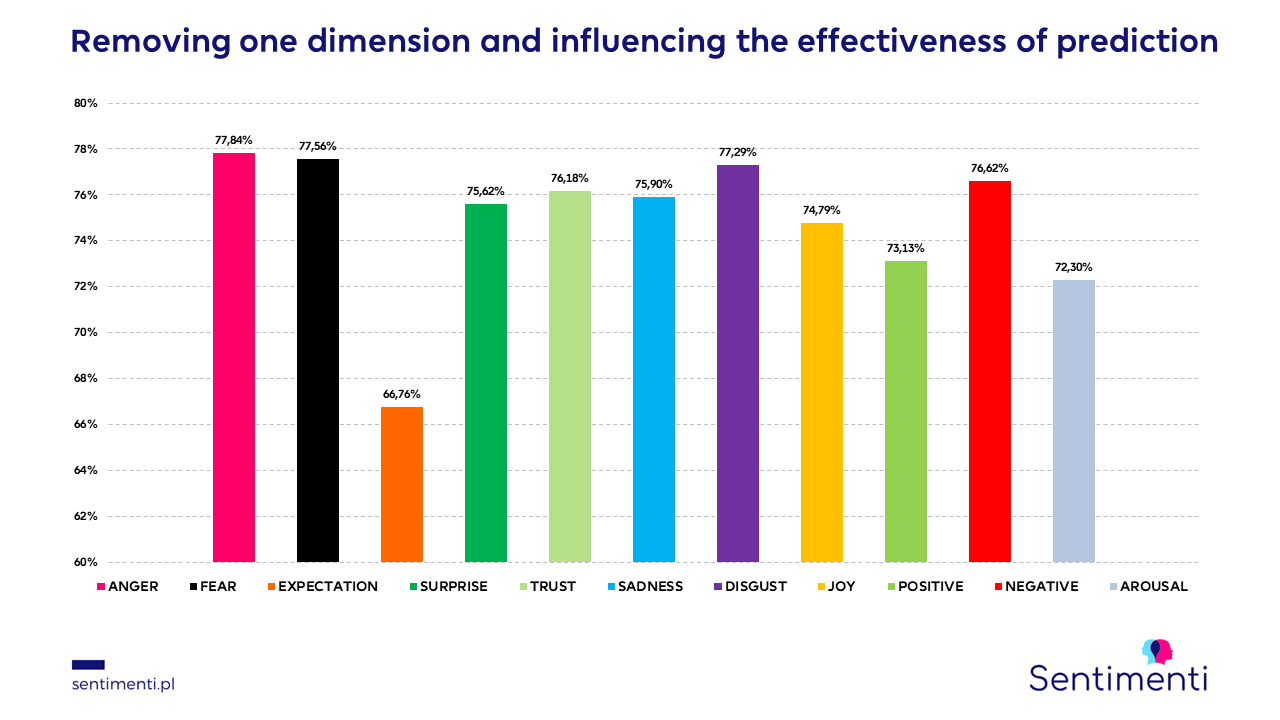

Removing one of the emotions

The number and choice of indicators considered are important. This can be seen in the graph shown above. Each of the variables influences the quality of prediction, it is enough to turn off e.g. emotion expectation for the quality to drop drastically. In other tests, we checked the effectiveness of prediction only on sentiment. Unfortunately, the results were far from the expected ones.

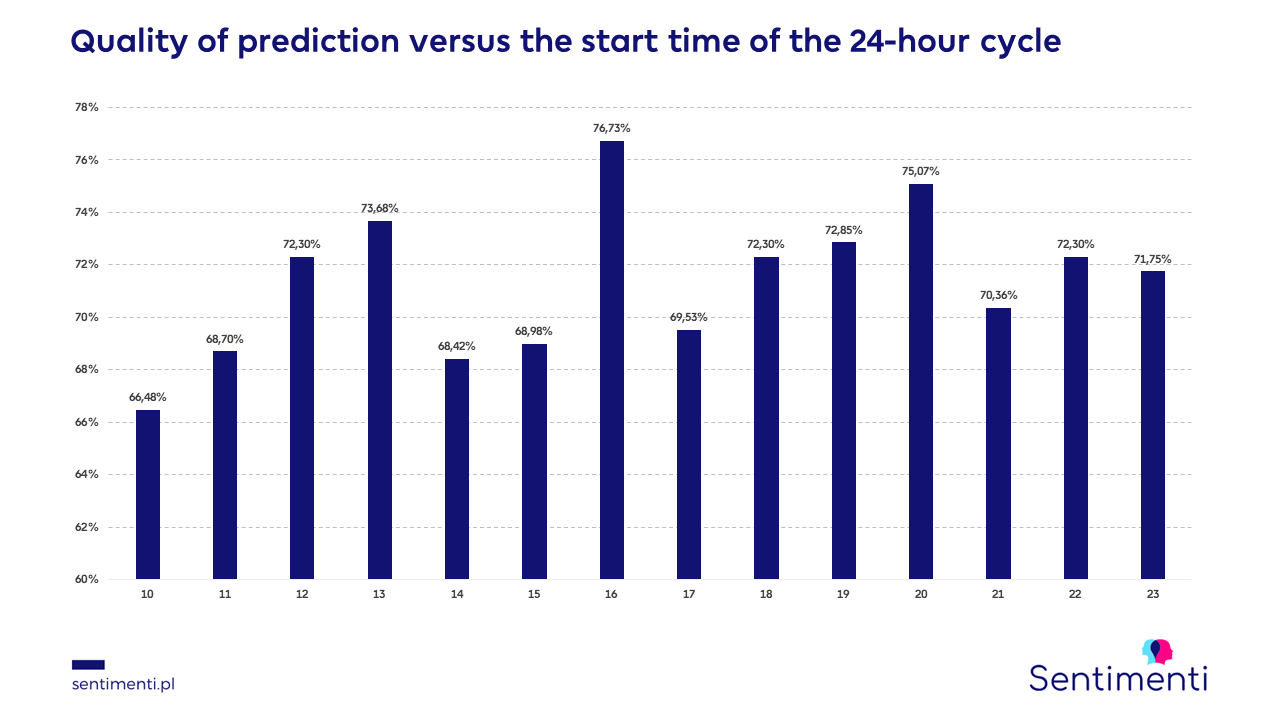

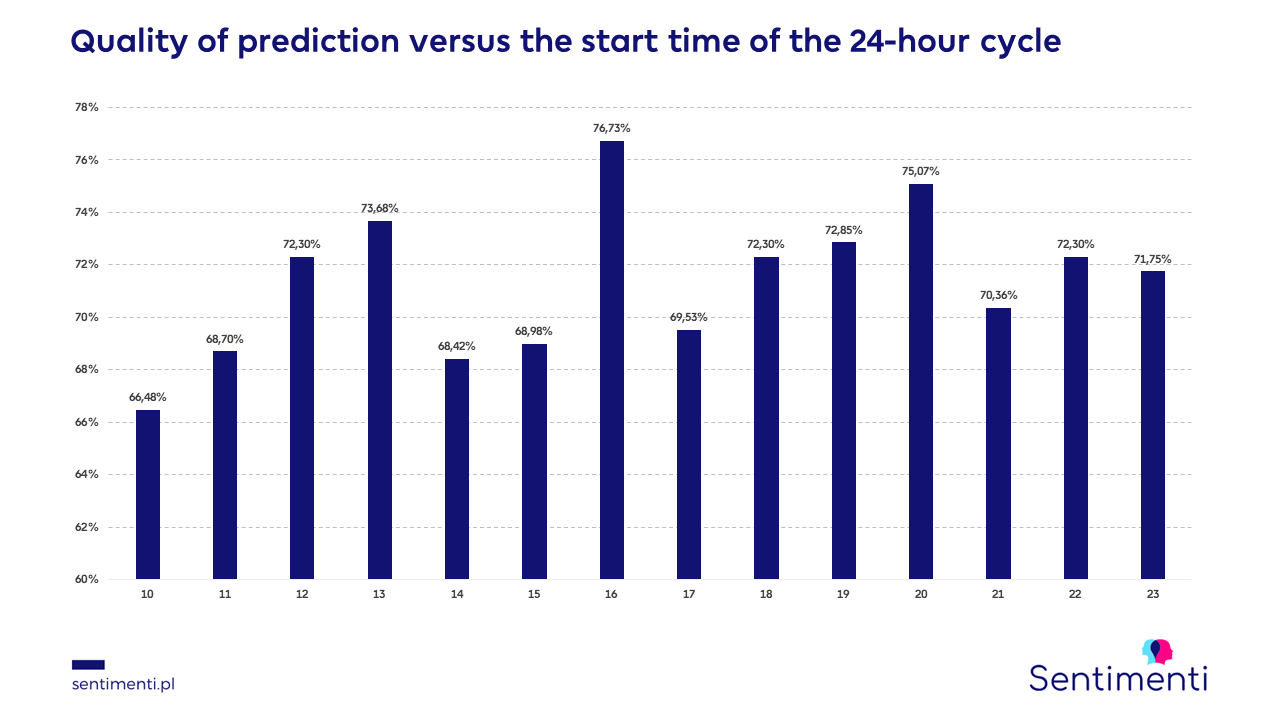

Quality of prediction vs. the time of the start of the 24-hour cycle

It turns out that the time when the forecasting starts is also important. In the time lapse between 10:00 and 23:00 the best results were achieved at 16:00 (76.73% effectiveness). This is the reason we take the hour to our daily forecasts.

Emotions on the crypto stock market: the final proof

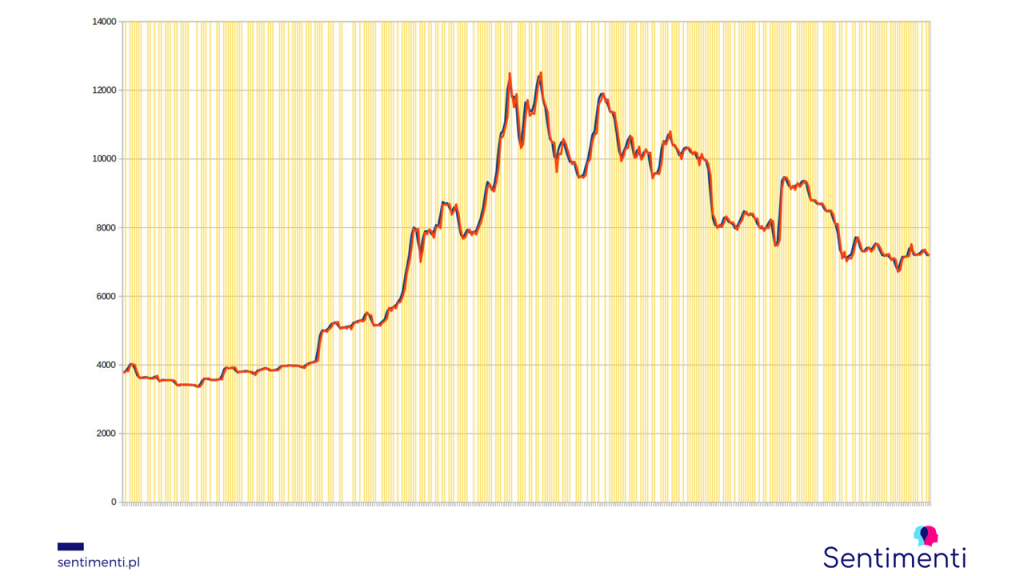

After these and dozens of other tests, this is how the results of the best possible set of variables for 2019 (learned on the 2018 model) are presented:

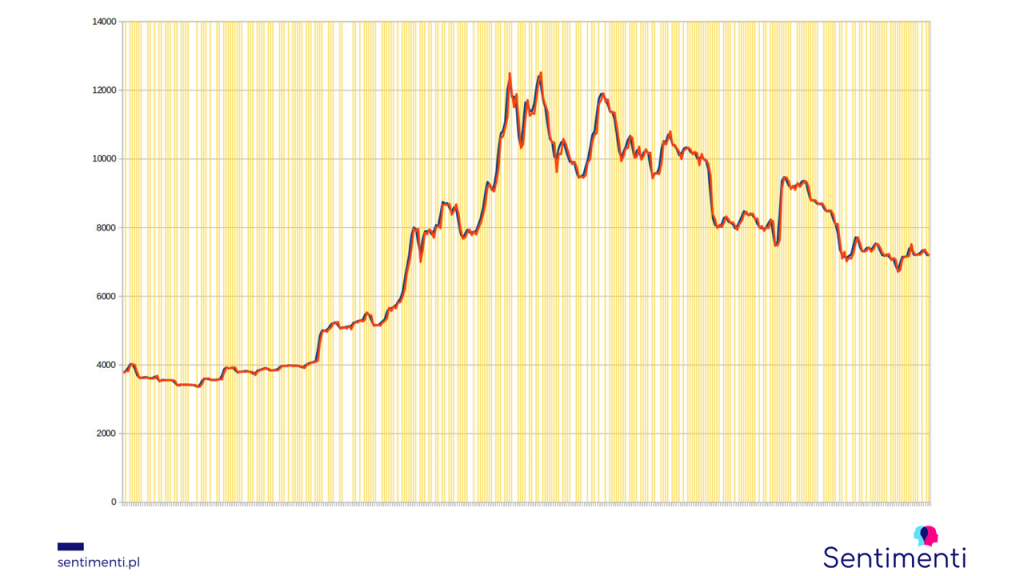

The X-axis is a period of 365 days. The Y-axis is the Bitcoin value in USD. Blue line is the real price, the red one is the forecast price. The yellow areas are the trend hits.

The prediction effectiveness, which is based on indicating the trend of price change, was 78.95%. As far as we know, such high effectiveness was not achieved in any of the previous studies researching emotions on the stock market. We are happy to see relatively small deviations between the actual and forecasted exchange rate (reaching a few percent at most). This is a good forecast for the already started tests of forecasting the numerical value of the course.

Take advantage of this knowledge and get access to information supporting your transactions. Measure emotions in the stock market and benefit from the results. We look forward to hearing from you!

by Grzegorz Stefański | Dec 21, 2018 | Sentistocks

This time the article was prepared by Grzegorz Stefański, our financial advisor. He proposed to check whether the emotions expressed in the entries about KNF (Financial Supervision Authority) will allow to predict changes in bank indices.

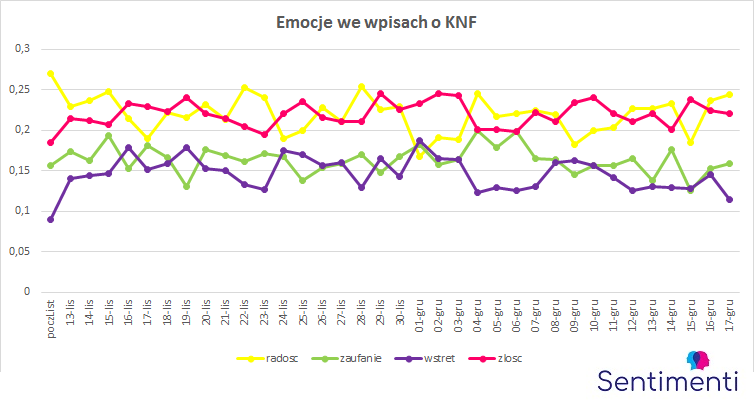

In Brand24 tool we collected data from the period from 1 November to 17 December. As there was not much writing about the Supervision Authority before 13 November, we treated these 12 days as one starting point for data to which we compare further changes in sentiment and emotions expressed by Poles. As can be seen in the chart, before 13, about 200-400 mentions were written daily. On the day the scandal broke out, the number rose to over 20 800 and until today it did not fall below 700 (the least talk was about the KNF on December 5).

The banking sector on the Warsaw Stock Exchange has always been regarded as one of the more stable and relatively insensitive to sudden fluctuations. However, this stable sector is not immune to sudden turmoil, either. For nearly two months now we have been able to follow the events related to the so-called “KNF scandal”. It is clear that the situation in the KNF was very important for the banks’ listing on the WSE in the form of at least two stimulators.

The first one is media information about a conversation between the then President of the KNF and the owner of Getin Bank. The second is the detention of former members of the KNF management. It was November 13th and December 6th respectively. These events had the same resonance for the banking sector. When analysing the changes in the WIG – Banks exchange rate in that period, we notice the following reaction of the stock market with some time delay. This applies to the WIG – Banks quotation on 16 November. On that day, one of the three lowest closing prices in a year (7161.54) was recorded, while on that day the lowest price in a year (7040.86). There can be no doubt that the reason for such a significant decrease was the media information about a conversation between the then President of KNF and the owner of Getin Bank. However, the banking sector itself defended itself with results in the following days, which resulted in an increase in the exchange rate, which was not weakened by reports of the arrest of the President of KNF by law enforcement authorities (this took place on 27 November). In this period, a mini upward trend in the exchange rate is noticeable. However, further information on the arrest of former members of the PFSA management on 06 December resulted in a significant drop in quotations – to the level of 7244.17 (on 11 December).

Source: bankier.pl

Source: bankier.pl

The question should be asked how the bank shares market will develop further? How much more turbulence is it able to withstand without causing negative reactions from stock market investors? Analysts often use the term investor moods – but what really makes up these so-called moods? Certainly, they are positively influenced by economic results, and also undoubtedly by investment safety. But investors are people who, regardless of measurable indicators, are also guided by emotions. The stock exchange is not free of emotions – we have seen it more than once. Also, the recent events related to the PFSA had a direct impact on the banking sector listed on the WSE. These events described by the media evoked certain sentiment and emotions among the recipients, and this could undoubtedly influence their behavior, causing for example the desire to get rid of their values.

At this point it is worth analysing – as a coincidence – the changes in the intensity of sentiment in the texts on KNF compared to the changes in the WIG – Banks exchange rate between 9 November and 17 December 2018.

Source: bankier.pl / sentimenti

Source: bankier.pl / sentimenti

Analysing the above chart one can notice a certain correlation between the changes in the intensity of sentiment in the texts about KNF and the behaviour of investors manifested in the WIG – Banks exchange rate fluctuations. Thus, in a situation when the positive (increase) and negative (decrease) sentiment curves were aiming to cross, it was a certain signal to increase the bank share price. It took place on 16 November and from that day onwards the price rose until 29 November. On that day the sentimentary curves spread out and a short-term price drop was recorded. After that day, the curves entered the convergence phase again and the price went up (until 05 December). On the next day (after information about the arrest of former heads of the Polish Financial Supervision Authority), the exchange rate fell. The sentimentary curves entered a phase of retreat and the exchange rate adopted a downward trend until 11 December. After that day, the sentimentary curves came close, and the exchange rate entered the upward phase again. However, since December 13th, the positive sentiment trend has seen a decrease (and at the same time an increase in negative sentiment), and this may suggest that in the following days there may be another downward correction of bank share prices.

In this analysis, only one element has been adopted which may affect the share price levels of banks listed on the WSE. This element is media information about the situation in the PFSA. However, it already gives some premises to start observing carefully and trying to study the emotions connected with the capital market. A more complete picture can be obtained by conducting broader research, especially of the basic emotions that function in the environment of investment processes taking place on the stock exchange.

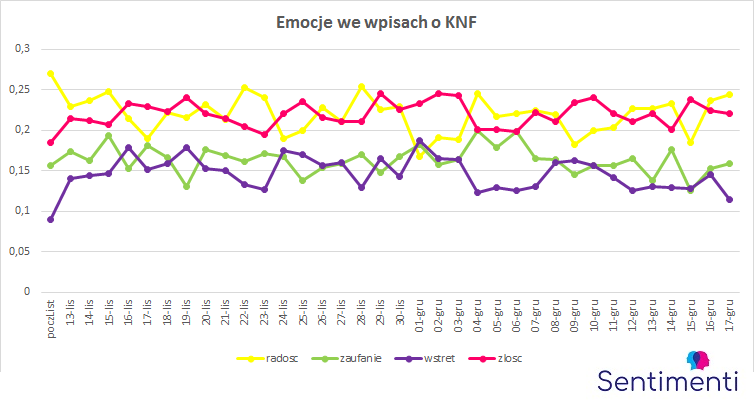

It is still necessary to consider how individual emotions have changed responding to subsequent reports of irregularities in the PFSA and whether they also have predictive power. The graph with the results of the averaged daily emotions indicates, first an increase in the proportion of disgust and anger and a decrease in joy. Strong fluctuations of trust can also be observed. SentiTool as a tool to help predict stock market trends? It seems that this is quite a possible scenario.

Source: bankier.pl

Source: bankier.pl Source: bankier.pl / sentimenti

Source: bankier.pl / sentimenti