by Sentimenti Team | Sep 14, 2020 | SentiBrand

Product reviews are extremely important for businesses. It doesn’t matter if it’s a local small business or a large conglomerate. Every business wants to climb to the top of the rankings on Google and inspire consumer confidence. It also wants online reviews to be only positive.

Product reviews and their value to your business

Product and service reviews that we come across online are very desirable for a business. They are the ones that increase search engine visibility and improve SEO. They also help build consumer trust and boost sales and conversions. They’re also a big advantage over the competition, as long as their content evokes positive emotions. The statistics speak for themselves. Reviews saturated with positive emotions can generate a lot of revenue. Products with an average rating of 5 stars receive up to 126% more orders than those with four stars.

On average, consumers read up to 10 online reviews before trusting a product or company. Up to 32% of consumers visit a company or product’s website after reading a positive review. SEO and SEO experts agree on this – generating online reviews is one of the top three best performing factors. 82% of consumers read online reviews of local businesses.

These reviews can provide the impetus for choosing between our company and a competitor. Online product reviews not only give consumers insight into the pros and cons of the products and/or services offered. They are also a great way to attract potential customers.

Online reviews and testimonials? The more of them, the better

While consumers will read many reviews before a brand inspires their trust, timing is crucial. Nearly half of consumers will only pay attention to reviews that have been written within the last 2 weeks and not a day more.

For many local businesses, the best place to build a review presence will be Google My Business. If you are dealing with a typical e-commerce business, you can build a profile on Trustpilot. Those in the hospitality industry can check reviews on TripAdvisor. Reviews can also be found on Facebook, Ceneo, GoWork and many other portals.

Analyzing online reviews, or what if there are already some?

You can do many things with online reviews. In addition to presenting reviews on your website, you can simply analyze their content and draw deeper conclusions. This allows you to go beyond star ratings and take your business to the next level.

Reviews can be a great source of information about your business or product. By analyzing the most common complaints about products, you can make improvements that will keep customers happy. The company through this will have better reviews in the future.

Review analysis, or the study of consumer emotions

Online reviews are an essential part of any business hoping to make a positive mark online and build consumer trust. Consumer reviews can be used to enhance brand reputation and improve services.

As an example, we used our tool to study emotions, arousal, and sentiment on several sample products. We took data from ceneo.pl from the last year.

The products were chosen quite randomly after taking into account only one parameter – a larger number of opinions in order to make the data representative. The group of tested products included several random phones, headphones and a water filter cartridge, cosmetics, medicine and a scooter.

- Apple AirPods 2 white (MRXJ2ZM/A)

- BRITA Maxtra Plus 5+1 pcs. Filter cartridge

- Apple iPhone 11 64GB Black

- Apple iPhone 11 Pro 64GB Star Grey

- Chlorchinaldin VP 20

- Xiaomi Mi Electric Scooter M365

- Long 4 Lashes Eyelash Growth Serum 3ml

- Xiaomi Redmi Airdots Black

- Samsung Galaxy A40 SM-A405 64GB Dual SIM Black

- Xiaomi Redmi Note 8 Pro 6/64GB Gray

- Xiaomi Redmi Note 8T 4/64GB Blue

These are probably not all reviews of these products, but this is mainly an example of a survey and how to analyze content from consumers. Below are the results:

As can be seen, the Brita Maxtra product received the highest intensity of positive emotion and favorable image sentiment in this analysis. In the group of randomly tested products, the Samsung Galaxy A40 received the worst score. The order of products was arranged according to the value of positive sentiment – from highest to lowest.

An analysis of the intensity of joy, trust and anger in the surveyed opinions shows that non-technological products (phones, handsets) have joy and trust much less. Phones are characterized here by more criticism. When it comes to emotional arousal, i.e. the strength of emotion and the type of words used to express it, the best performer is Chlorchinaldin VP-20, and the worst – again – is Samsung Galaxy A40. This may mean that the criticism was not so strong in the case of this device, but it outweighed the positive emotions.

Selected negative with highest anger intensity:

- Unfortunately, the headphones COMPLETELY do not stick in the ears, no matter what kind of covers you use, and the second day one of them fell out of the ear and got lost. DO NOT RECOMMEND. 200 PLN thrown down the drain.

- Impressed by the positive reviews, I bought them at a low price. Very stable hold in the ear, have a nice case but that’s actually the end of the advantages. The manufacturer did not include any instructions so I had to reach for “tutorials” and “unboxingi” on youtube. In vain – the left earphone did not want to pair with the right one. It is worth knowing that the left handset connects with the right one and the right one connects with the phone. Several reset attempts did not help.

- Chinese fakes. The headphones cannot be paired with each other, despite following many instructions from the net. Both headphones are detected as right. No instructions in the box. No cable.

- 100% counterfeit I own the original and from this store. These fakes are not even 50% of the capabilities of the originals. I do not recommend

Selected negative with highest joy intensity:

- I have been using Brita for a long time. I stopped buying water at the store (especially in plastic) a long time ago. We have great quality tap water. After pouring it through the brite I am at peace with the quality. I recommend it to everyone. Great product.

- Very good quality. Son satisfied. I recommend

- Good quality product, fast delivery, everything is fine – I recommend 😉

- I bought it for a gift. My boyfriend is very happy and praises it. I recommend

As you can see, Sentimenti tool analysis allows you to not only examine the emotion saturation of review content. It also allows you to quickly categorize reviews into positive and negative. This process gives quick (in just a few minutes) and precise results. The above sample survey is just a prelude to further in-depth analysis. This type of research is done by Sentimenti team as a part of SentiBrand service.

by Sentimenti Team | Aug 28, 2020 | Sentistocks

Sentistocks emerges on the market with a very innovative approach to crypto analysis. The Sentimenti project focuses on the use of 8 emotions measurement and arousal to accurately predict the price trend of market assets.

From now on it has collaborated with leading cryptocurrency data aggregator – Coinpaprika to provide a new feature – widget presenting daily forecast for Bitcoin (BTC) price.

The tool will be constantly improved and expanded with more features to analyze the most important cryptocurrencies for key stock exchanges, in shorter intervals (1hr – 8hrs).

Soon, there will be expanding solutions, analyzing the most important cryptocurrencies for key exchanges, in shorter intervals, between 1h and 8h.

Sentistocks, apart from the crypto market, applies its innovative analyses on other markets and instruments, such as stock indices or F/X market.

by Sentimenti Team | May 8, 2020 | Politics and Social

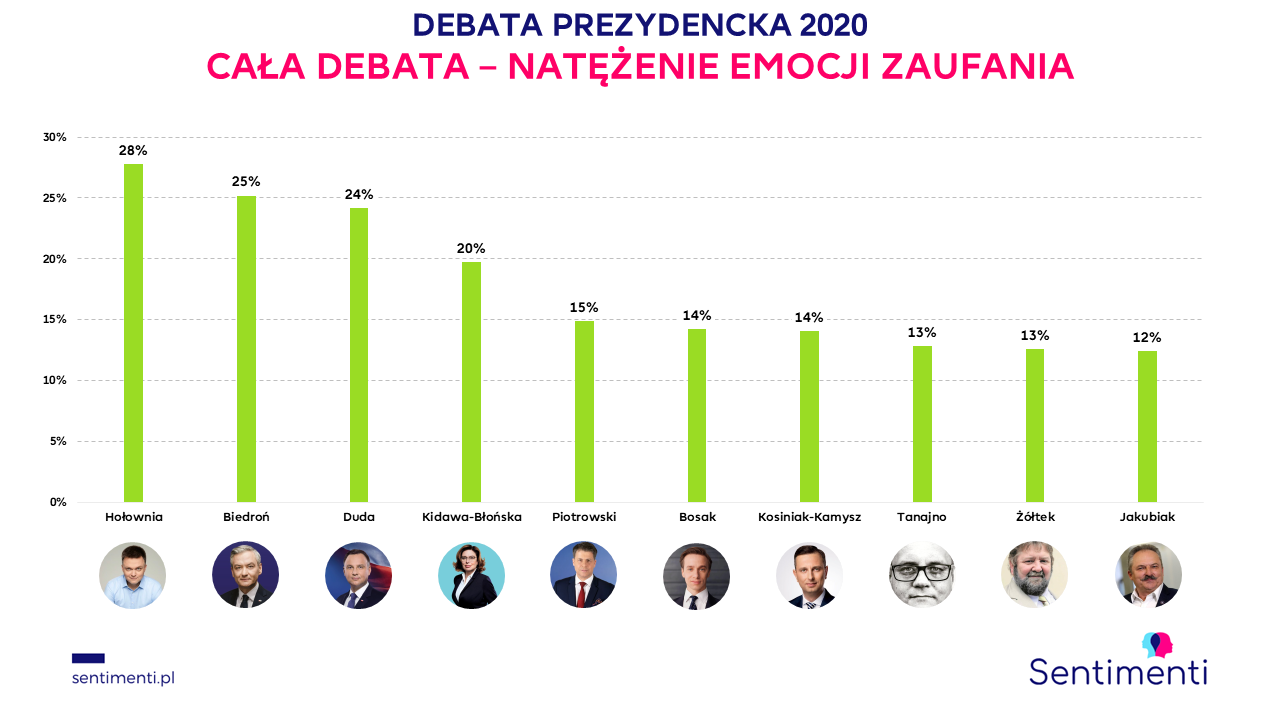

The presidential debate took place on the 6th of May in the TVP headquarters. First of all, it was the first debate before the presidential election with the full line-up, i.e. with all 10 participants – candidates for the head of state’s seat. On the basis of the publication placed on the portal polskatimes.pl – “2020 Presidential Debate: Who won? [SONDA] Ten candidates debated in TVP before the election [RELATION]” the Sentimenti team of analysts prepared an analysis of emotions that were evoked by the statements of the individual candidates. At the time of the analysis polskatimes.pl was the only such extensive source presenting the debate.

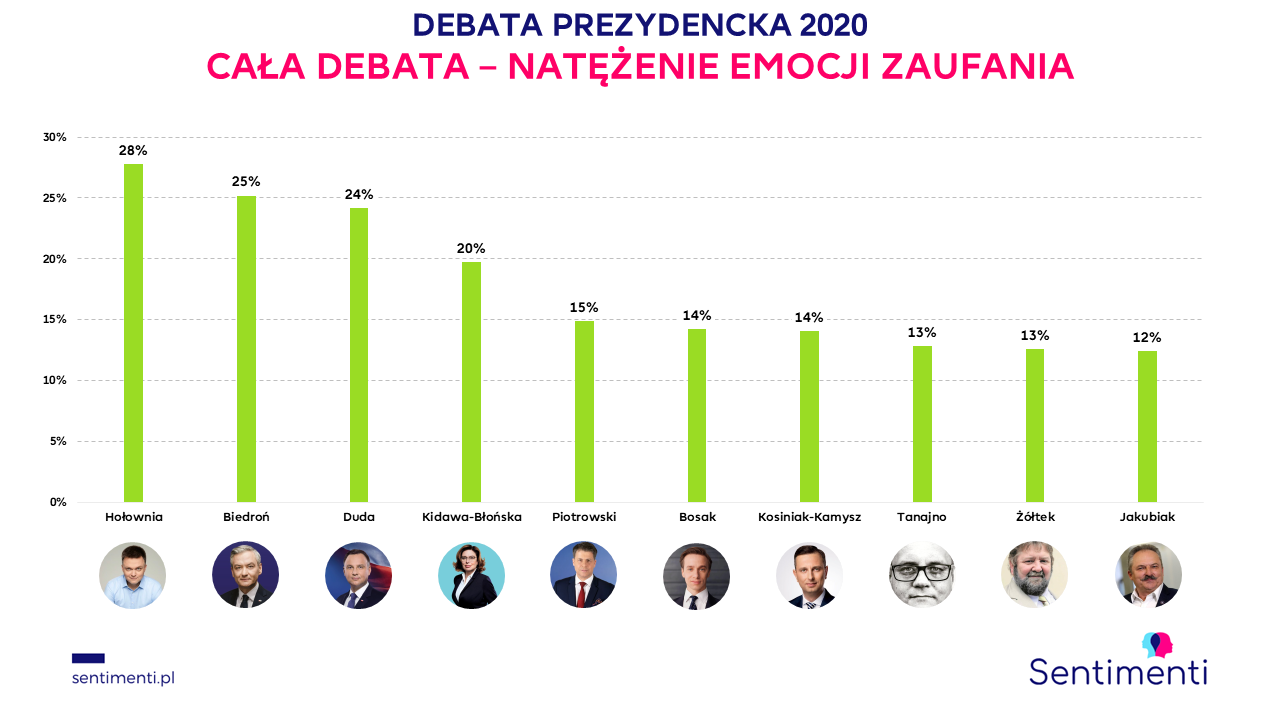

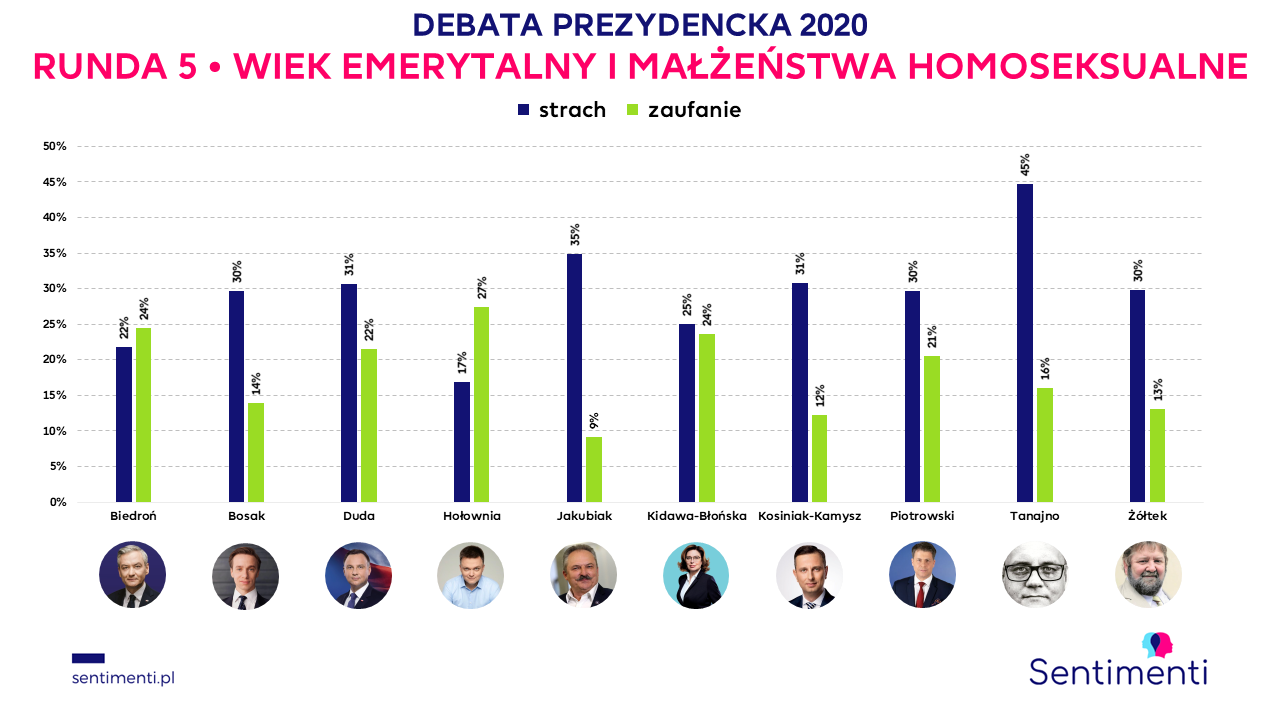

2020 Presidential Debate – Confidence and Fear

The analysis was done for the two most important opposing emotions, trust and fear. The intensities of these emotions were examined for, respectively:

- the entire debate;

- for individual 5 rounds of questions;

- for all 10 presidential candidates.

Results of the analysis

The presidential debate as a whole – strong emotions of trust and fear in candidates’ statements

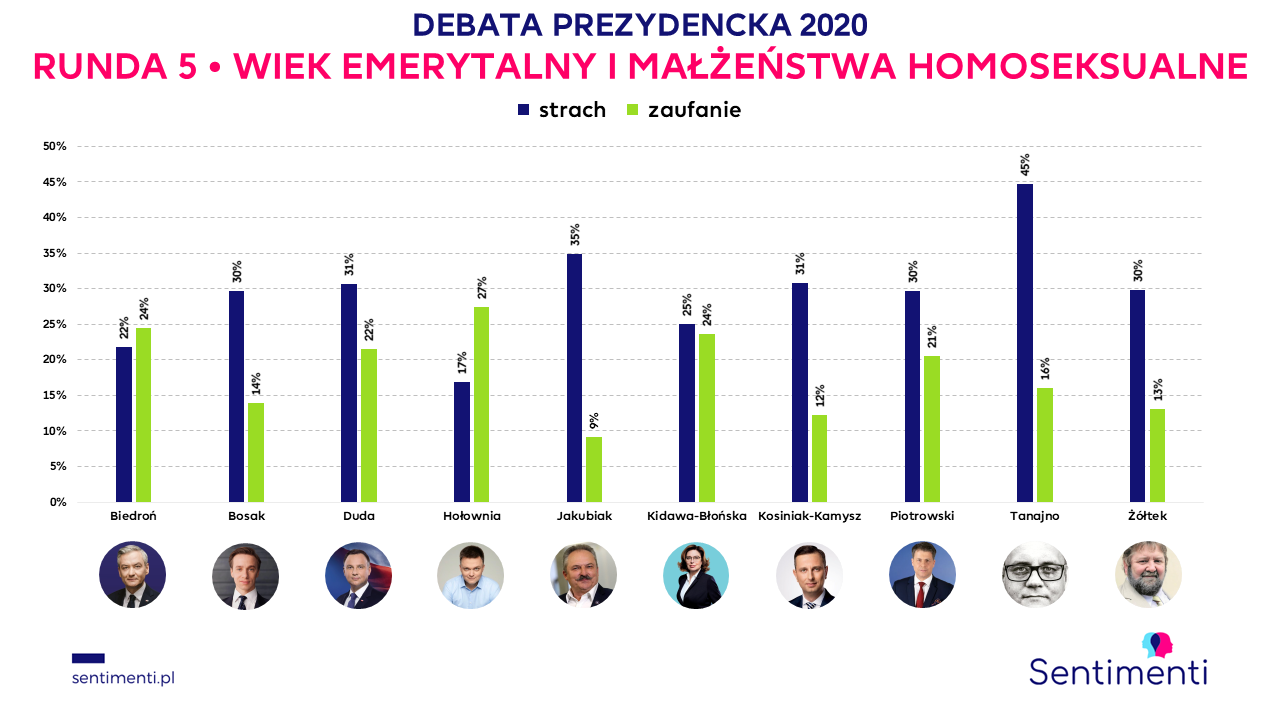

5 rounds with questions by candidate

Free speech by the candidates at the end of the debate

Politics is a game of emotions, and these were lacking

This time we will not present the conclusions, so we leave the presented results of the analysis to your own interpretation. However, it is worth mentioning that the format of the debate left much to be desired. From the point of view of emotions it was, above all, a spectacle for the eyes (we can not complain about the visual side). It’s hard to say anything good about the substantive layer, that is the one that shouldn’t and shouldn’t cause any emotional stimulation.

Politics is above all a game with emotions. One can risk a thesis that we did not deal with a fight for the future of Poland and its citizens but, at the most, with a more boring version of ‘One of Ten’. There was no real discussion, which would open any space for candidates to present themselves and their idea for presidency.

There was also no opportunity to show the strengths and weaknesses of the candidates. Each presented himself according to his abilities measured by few minutes of speaking time. To sum up – it is hard to say anything good about the show, during which the most stimulated person was the sign language interpreter in the corner of the screen, who probably had the opportunity to catch our attention more often.

by Sentimenti Team | Apr 7, 2020 | Sentistocks

In today’s financial world, access to accurate, real-time data is a key factor in making informed decisions. Fintech solutions have transformed the way stock markets operate, providing new tools for analysis, including those focused on understanding investor sentiment. Sentimenti, a Polish-based company specializing in emotion analysis, has recently applied its advanced technology to analyze the emotions surrounding Polish stock market companies.

Sentiment Analysis in Stock Market Forecasting

In December 2018, the International Monetary Fund IMF published “Media Sentiment and International Asset Prices” analyzing Reuters and Bloomberg articles’ impact on stock indices. Key findings include:

- News sentiment correlates more strongly with bear markets.

- Sentiment is a better predictor of global indices than VIX (CBOE Volatility Index).

- Positive media sentiment influences developed markets positively but affects emerging markets negatively.

Unfortunately, these methods only achieve 55-60% accuracy, likely because they rely on emotional tags from social media.

Emotional monitoring for stock price forecasting

What if we combined media and emotion monitoring using deep neural networks? Sentimenti’s tools allow for the analysis of 11 emotional variables in texts (8 basic emotions). We track sentiment and specific emotions, measuring their intensity and changes over time. We then compare these findings with hard indicators, like the WIG-Banks index and company share prices.

Emotions on the Warsaw Stock Exchange

In late 2018, we tested our models with data from 50 Polish companies. Remarkably, in 87.1% of cases, changes in emotional intensity predicted stock price changes! Our report, featuring companies like CD Projekt and KGHM, details these findings.

Global Applications: Why Emotion Analysis is the Future

While this report focuses on the Polish market, the implications of emotion analysis are global. Financial markets around the world are increasingly influenced by the emotions and perceptions of investors, particularly in an age where information spreads rapidly across social media and online news platforms. Sentimenti’s technology provides a scalable solution for analyzing these emotions in any market, offering a competitive edge to investors and financial institutions.

By integrating emotion analysis into their decision-making processes, global financial institutions can anticipate market movements with greater accuracy. As fintech continues to evolve, tools like those developed by Sentimenti will become indispensable in navigating the complex emotional dynamics that shape modern financial markets.

Conclusion

Sentimenti’s emotion analysis technology is a powerful tool for understanding the emotional undercurrents driving stock market behavior. With its application in the Polish stock market, the company has demonstrated the value of emotional insight in financial decision-making. As markets become more volatile and influenced by real-time information, emotion analysis will play an increasingly important role in predicting market trends and helping investors make informed choices.

by Sentimenti Team | Apr 7, 2020 | Sentistocks

Are emotions more effective on the stock market than the sentiment is? How effective are they? We have long been studying the importance of emotions in economic analysis. How they affect the prices of various financial instruments and values quoted there. We are not the only ones – for some time now, with increasing access to published opinions, whether on portals or in social media, there are publications and researches where authors try to find correlations between investors’ mood and stock, currency, crypto rates, etc.

December 2018 revealed the publication of “Media Sentiment and International Asset Prices”, issued by the National Bureau of Economic Research. In the aforementioned read, its authors have analyzed in Reuters’ and Bloomberg articles on their impact on major stock indices. Researchers discovered interesting relationships between sentiment and index values, amongst the others:

- The mood of the news correlates four times stronger with the bear market (dominated by declines) than during the bull market (boom),

- Emotions are a much better indicator of world indices’ behaviour than the commonly used VIX (CBOE Volatility Index),

- The positive mood in the media has a more positive impact on the developed markets, but a negative one on the emerging markets.

A similar topic was researched by Yigitcan Karabulut, Goethe University Frankfurt’s Assistant Professor. He analyzed predictions on a Facebook database.

None of the approaches, unfortunately, allowed the results’ accuracy of forecasts to be higher than 55-60%. This will not be possible whilst basing on sentiment or emotional tags offered by social networking platforms like Twitter or Facebook only. In Sentimenti, we have many more possibilities – up to 11 emotional variables. Do you want more information? Look below.

Sentimenti and the Warsaw Stock Exchange

In Sentimenti we took on another milestone in financial behavioral analysis. We use deep neural networks to analyze any published text based on 8 emotions and the overall arousal. Thanks to the idea we can read investor’s moods and predict their future actions more precisely. We have already proved it by checking our tools’ effectiveness on publications related to the Warsaw Stock Exchange. As many as 87.1% of the cases with shown changes in the emotion intensity area in texts about a certain company allowed us to predict the price changes.

Sentimenti and cryptocurrencies

For everyone who has even a little interest in the market, the cryptocurrencies are known for their strong emotional connection. Values such as Bitcoin, Ethereum (or others!) don’t have a real use so far but are mainly treated as purely speculative assets. And where speculation is concerned, there also are emotions.

That is why we have set ourselves the goal of checking how strong the correlation between cryptocurrencies and emotions is. And, by the way, does the same scheme work with the positive and negative sentiment only?

To that end:

- We have downloaded all available mentions of Bitcoin (BTC) for 2018 – over a million articles, comments, or posts.

- We have examined them emotionally for 11 indicators – 8 emotions, negative and positive sentiment, including arousal,

- for the tested period we have downloaded the price quotations, including opening, closing, minimum and maximum price, taking them hour after hour (over 35 thousand indicators).

We have then implemented our artificial intelligence to help. Our IT-team inserted all the data collected for analysis and set it the task for finding correlations between these several dozen variables, both on the side of stock market prices and emotions.

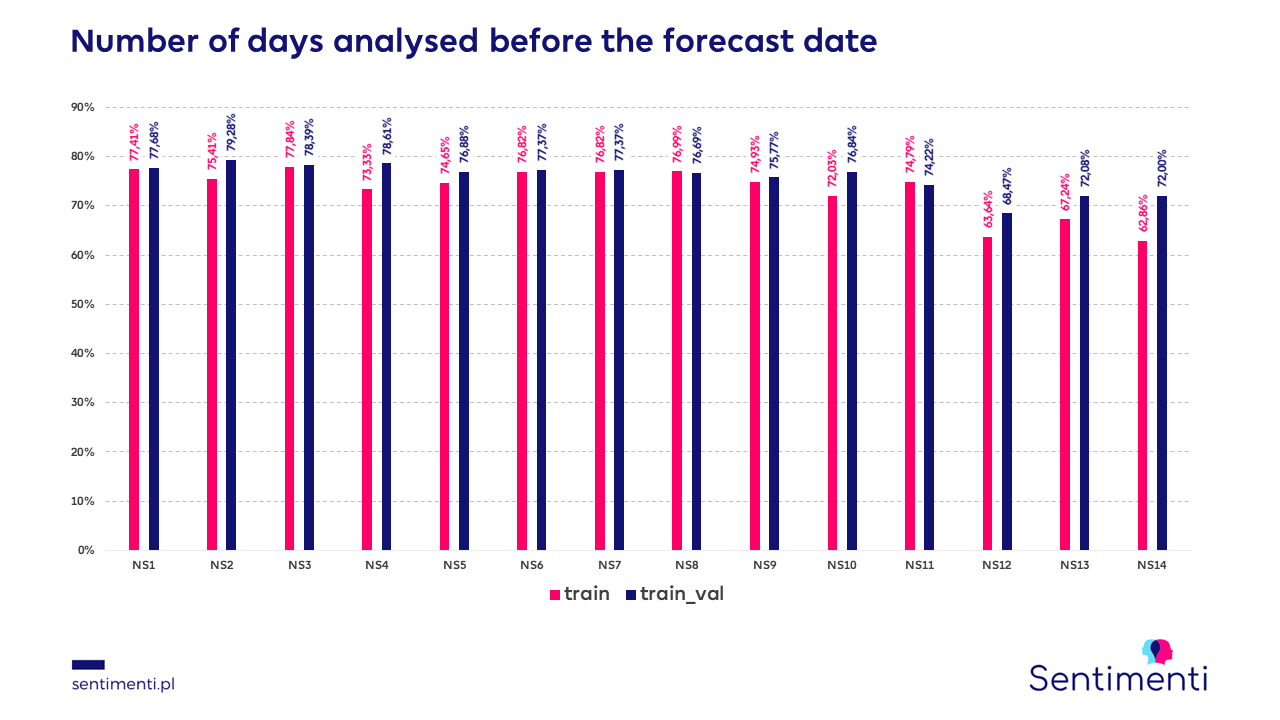

We have tested the 2018 datasets on a total of several hundred different training models. Then we started forecasting the best of them for 2019. We changed the approach several times, looking at the effectiveness each time. A few examples of this analysis ale pictured below:

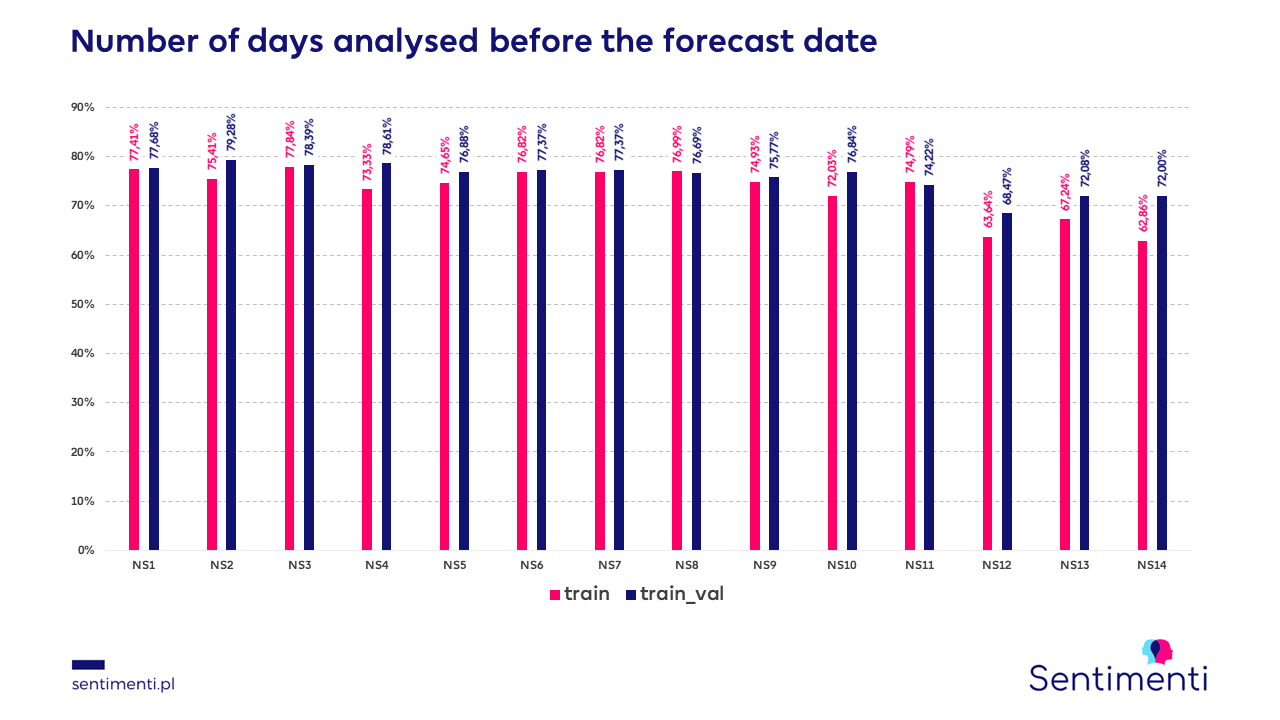

The number of days analysed before the forecast day:

We checked which number of days back best affects the quality of the predictions. We examined periods from one to fourteen days. It turns out that the best results are obtained when we analyse the last three days (77.84% effectiveness of the prediction).

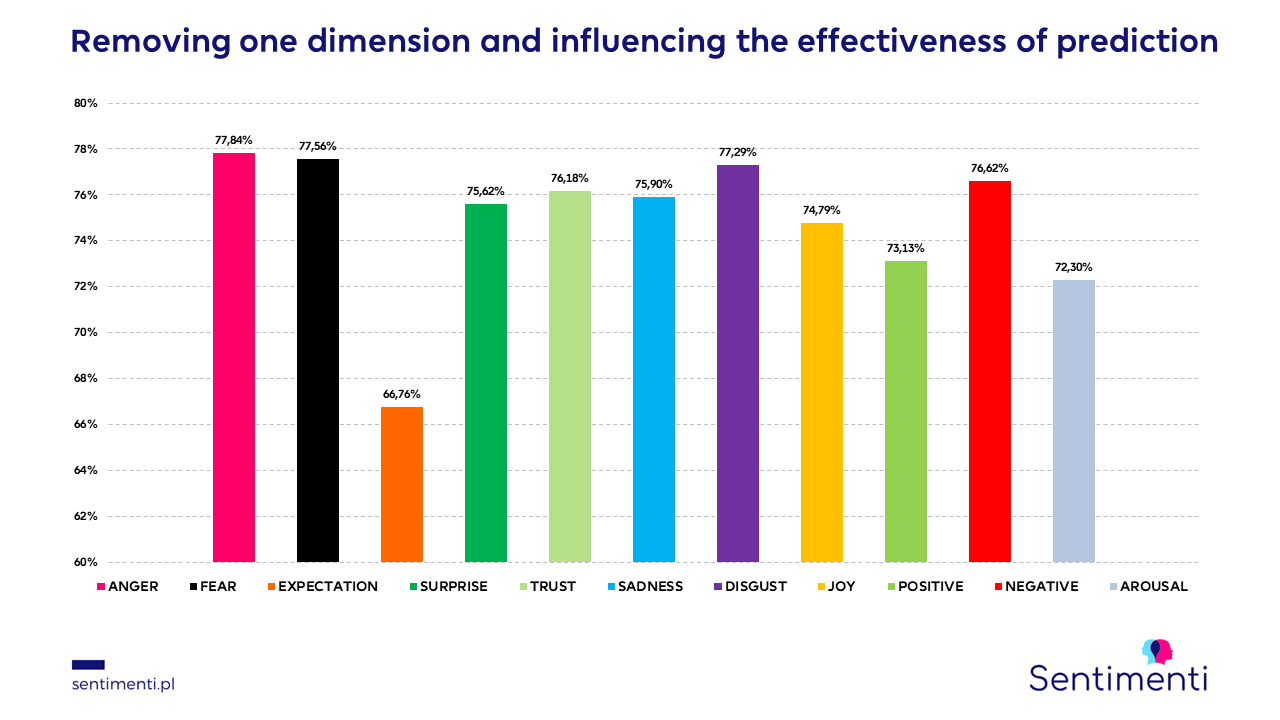

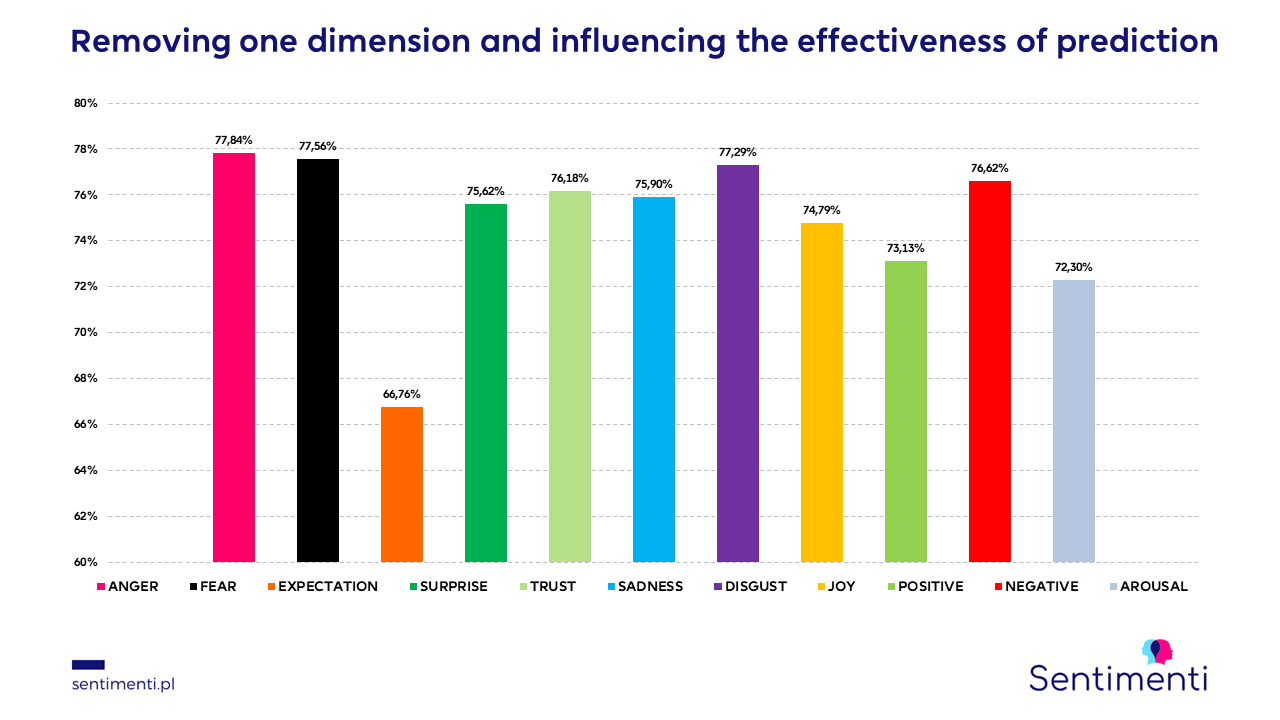

Removing one of the emotions

The number and choice of indicators considered are important. This can be seen in the graph shown above. Each of the variables influences the quality of prediction, it is enough to turn off e.g. emotion expectation for the quality to drop drastically. In other tests, we checked the effectiveness of prediction only on sentiment. Unfortunately, the results were far from the expected ones.

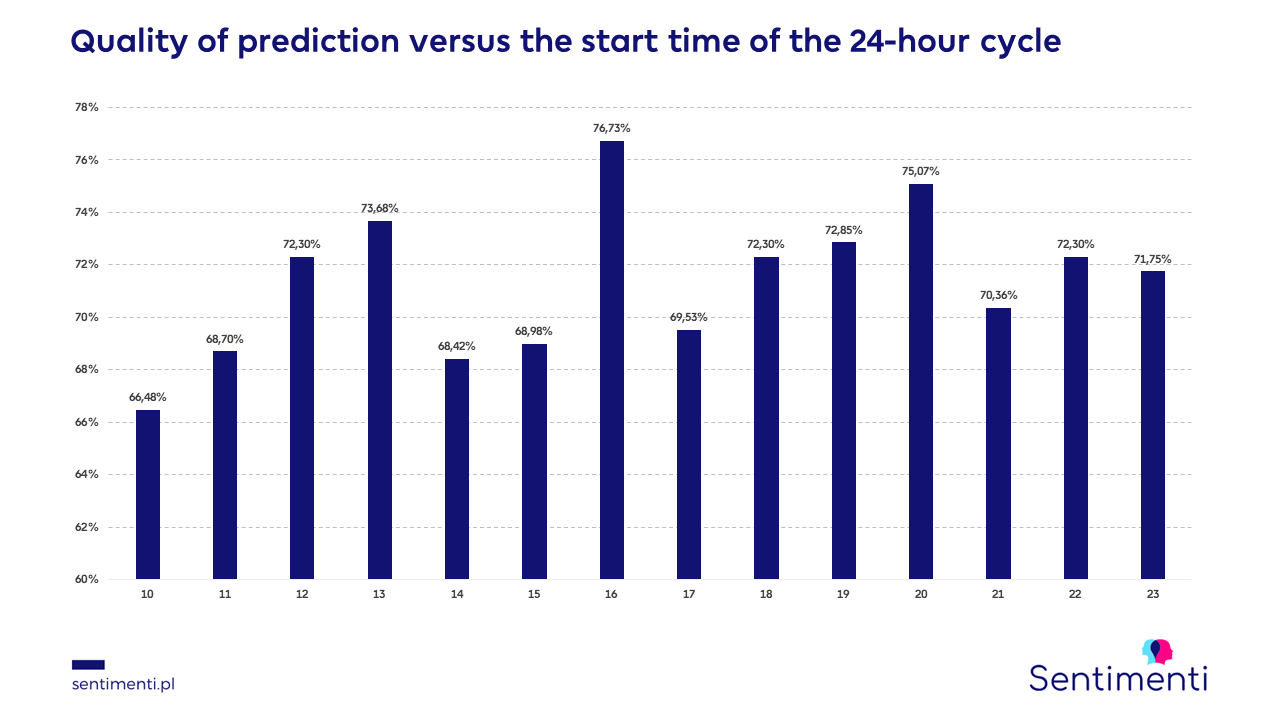

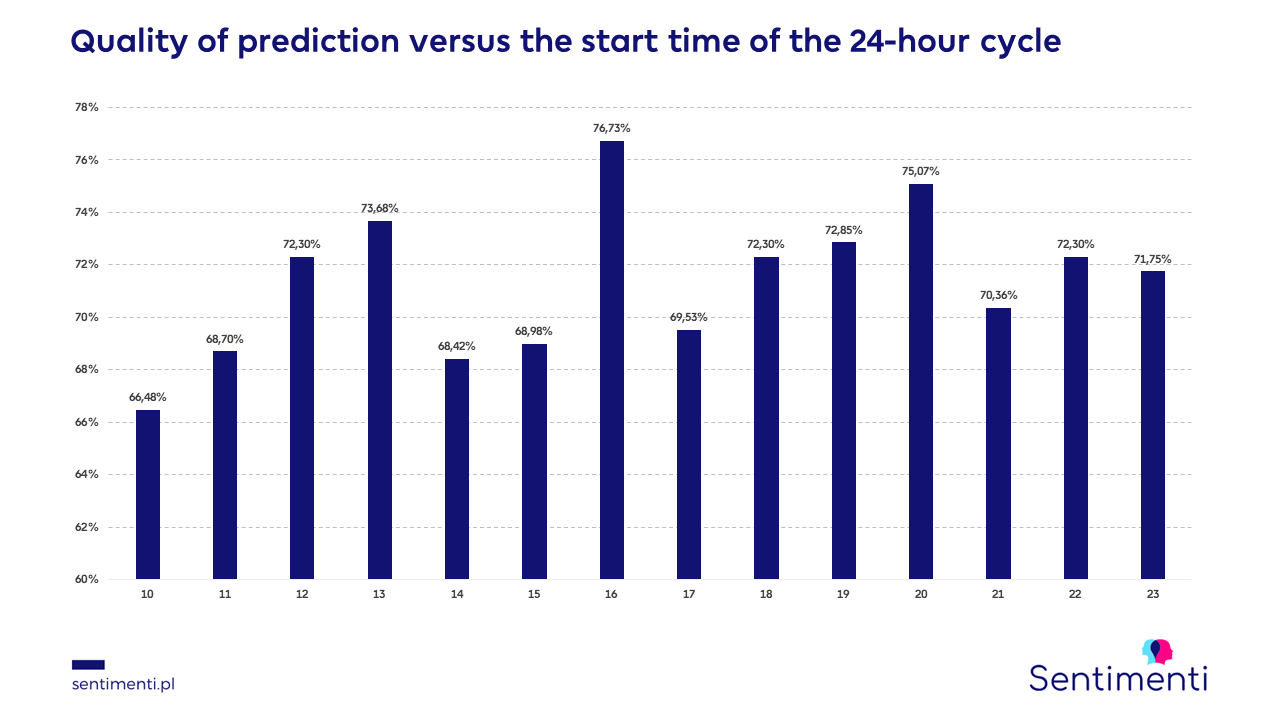

Quality of prediction vs. the time of the start of the 24-hour cycle

It turns out that the time when the forecasting starts is also important. In the time lapse between 10:00 and 23:00 the best results were achieved at 16:00 (76.73% effectiveness). This is the reason we take the hour to our daily forecasts.

Emotions on the crypto stock market: the final proof

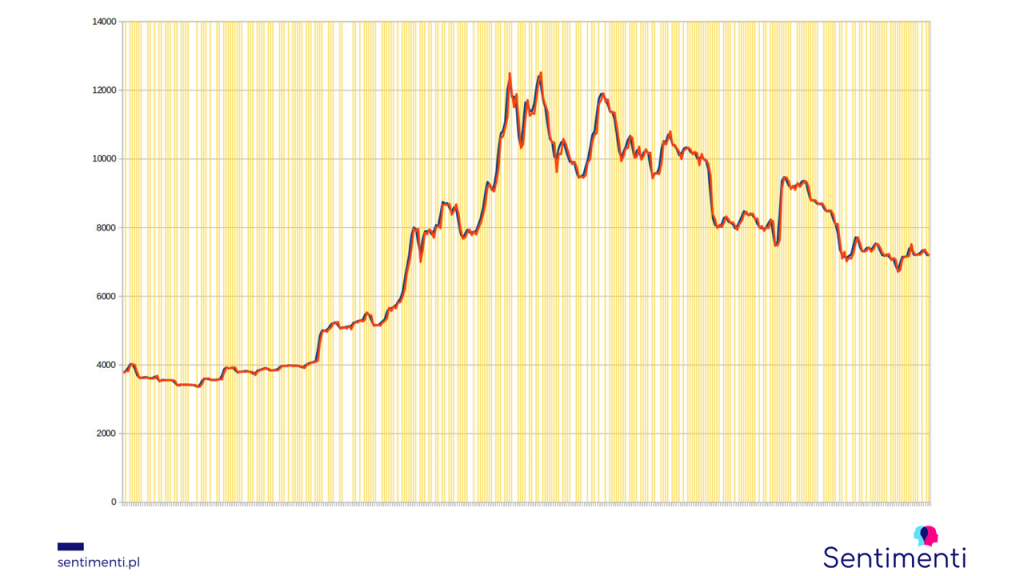

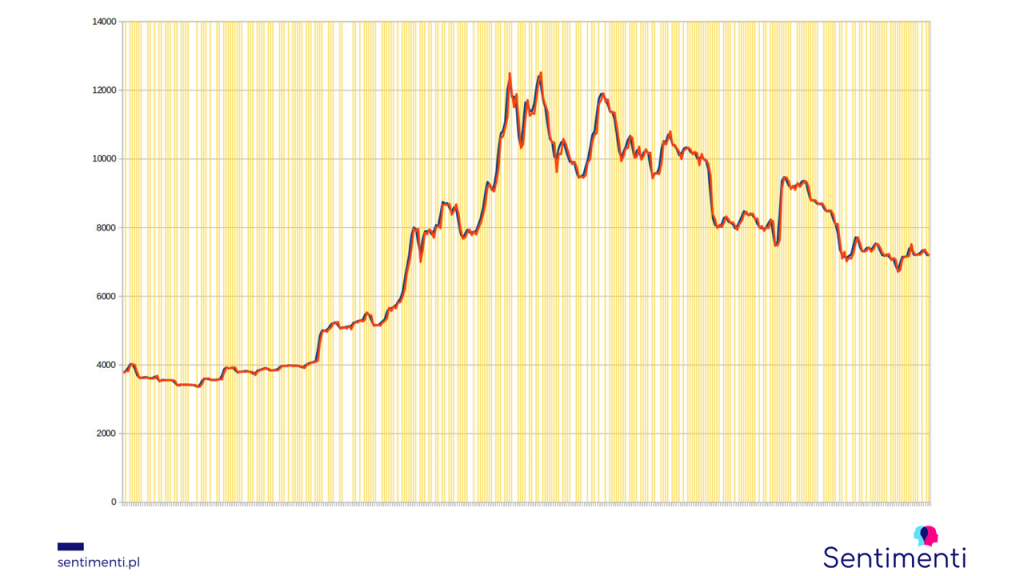

After these and dozens of other tests, this is how the results of the best possible set of variables for 2019 (learned on the 2018 model) are presented:

The X-axis is a period of 365 days. The Y-axis is the Bitcoin value in USD. Blue line is the real price, the red one is the forecast price. The yellow areas are the trend hits.

The prediction effectiveness, which is based on indicating the trend of price change, was 78.95%. As far as we know, such high effectiveness was not achieved in any of the previous studies researching emotions on the stock market. We are happy to see relatively small deviations between the actual and forecasted exchange rate (reaching a few percent at most). This is a good forecast for the already started tests of forecasting the numerical value of the course.

Take advantage of this knowledge and get access to information supporting your transactions. Measure emotions in the stock market and benefit from the results. We look forward to hearing from you!